This is vital to making a backtest that truly reflects a strategy’s ability to adapt to market changes. Traders have a extensive range of choices to choose from for their backtesting wants, together with using a demo account. It’s about embracing persistence, ready for the market to signal when your strategy’s circumstances back to back test are ripe. It should be a software that simplifies the method, allowing you to focus on technique growth quite than wrestle with complex software navigation. Software testing, in which two or more variants of a component or system are executed with the same enter values and the outcomes are compared and analyzed in the case of a distinction between them. This testing methodology assigns all credit score for performance variations to the designs somewhat than the test environment.

How Can Backtesting Assist Traders Adapt To Market Volatility?

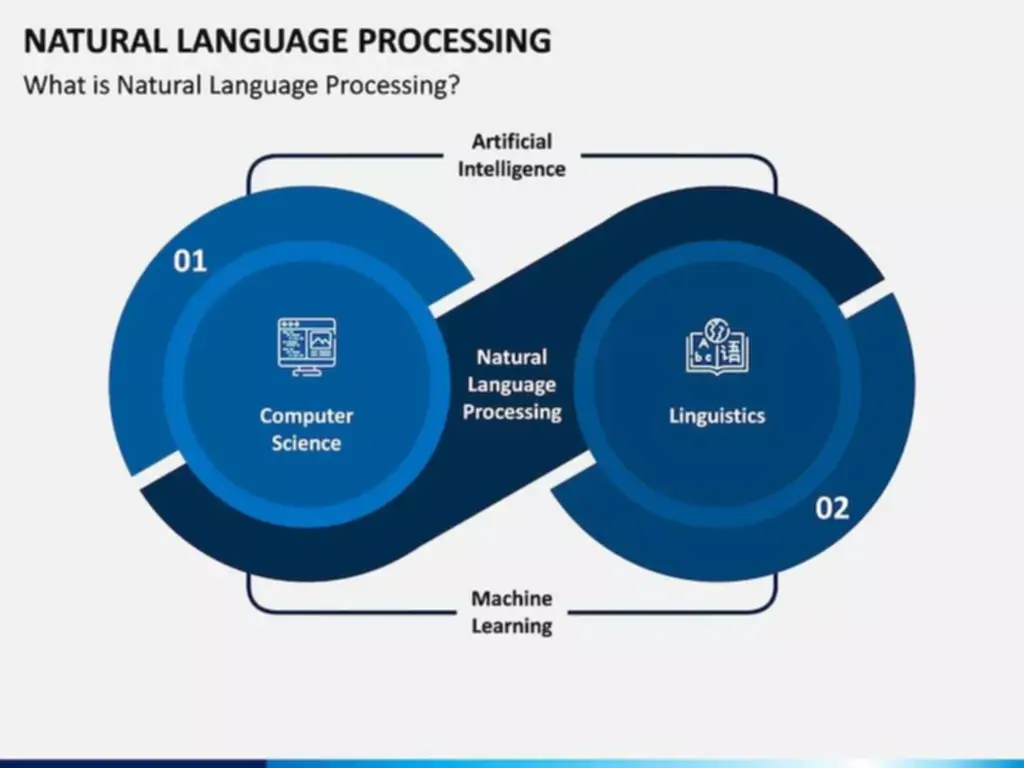

This contains figuring out the systems or parts that shall be examined, the particular efficiency metrics that might be measured, and the conditions beneath which the exams might be run. All these phases of software development are immensely important and play a vital position in the Software Development Life Cycle (SDLC). Software Testing, which is executed all through the development process, validates the quality https://www.globalcloudteam.com/ of the product and ensures its performance and effectiveness.

How Do You Account For Altering Market Dynamics In Backtesting?

It visualizes how the varied objects like tables, columns, and fields, are organized and related in the database. Testing the frontend entails validating those parts of the application which are visible to the end-users (e.g. forms, menus, navigations, and so forth.). The ECMWF re-analysis is an example of a mixed atmospheric reanalysis coupled with a wave-model integration where no wave parameters were assimilated, making the wave half a hindcast run. It’s about understanding when your technique stands tall and when it’d falter, arming you with the foresight to navigate the treacherous waters of buying and selling.

To Ensure One Vote Per Individual, Please Embrace The Following Data

To make comparisons meaningful, select actions that result in distinguishable outcomes between the systems. Two major approaches are suitable for performing this testing process – automated and handbook. Since this check includes restricted instances, it might reflect something other than the systems’ performance in real-world eventualities. At this part, you must be positive that all required hardware and software program are installed. When we examine two parts in back-to-back testing, we are actually measuring the parameter values generated through certain actions on each of them.

Why Do We Always Go Excessive With Standards And Methods?

A correct check ought to be carried out to guarantee that the information are timely and correctly retrieved. Newsom’s veto got here after he signed 17 different AI-related legal guidelines, which impose new restrictions on a few of the same tech corporations that opposed the bill that he blocked. Opponents also argued that those that used AI for hurt — not the developers — should be penalized. I record the date of the commerce, the hour of the day, and the kind of buying and selling setup of every trade (columns A, B, and C in the screenshot below). I just create a new folder for every backtest that I carry out after which retailer them on my exhausting drive.

Headiwhat Are The Variations Between Backtesting Equity And Spinoff Strategies?ng

It’s additionally crucial to acknowledge that backtesting, while valuable, can’t absolutely replicate the psychological pressures of real-time buying and selling. As such, it ought to be complemented with other instruments and strategies for a more holistic buying and selling strategy. Ultimately, backtesting is about learning and evolving as a trader, continually refining methods to adapt to the dynamic world of on-line trading. In conclusion, backtesting stands as a critical element in the toolkit of any dealer.

- Backtesting allows a dealer to simulate a buying and selling strategy utilizing historical knowledge to generate results and analyze threat and profitability earlier than risking any precise capital.

- One significant advantage of this check is that it helps you perceive your design construction.

- Backtesting refers to the means of testing a predictive mannequin or a trading strategy on related historic data to ensure its viability earlier than it is employed in a real-world situation.

- Backtesting options buying and selling strategies involves simulating trades with specified contracts over chosen durations, analyzing efficiency metrics corresponding to win rate and common revenue.

These strategies provide fresh views on performance and help ensure that methods stay effective in diversified market situations. A backtest should contemplate all trading costs, nonetheless insignificant, as these can add up over the course of the backtesting period and drastically affect the appearance of a strategy’s profitability. Traders should be sure that their backtesting software program accounts for these costs. The ideal backtest chooses pattern data from a related time interval of a period that displays a variety of market circumstances. In this fashion, one can higher judge whether or not the outcomes of the backtest symbolize a fluke or sound trading. Backtesting permits a trader to simulate a trading technique utilizing historic data to generate outcomes and analyze risk and profitability earlier than risking any actual capital.

To sum up, back-to-back testing is a crucial part of software testing as it helps determine whether a software program system works as expected after a major launch. By doing so, you make certain that all versions you release are bug-free and ship the same expertise to your finish person. It has reached a great reputation because of its being effective, fast and time-saving.

It must be balanced with real-time market analysis and the most recent macroeconomic developments, guaranteeing that your methods are not just battle-tested towards historical past but also agile within the face of current market realities. It’s the ongoing monitoring and evaluation of your strategy’s efficiency that assures its evolution in maintaining with the markets. But even the most promising backtesting outcomes come with a caveat—they usually are not a crystal ball into the longer term. Markets are ever-changing, and a strategy that flourished in the past might falter beneath new conditions. It’s a reminder that optimistic backtesting outcomes aren’t a assure but a information, steering your trading selections with informed predictions rather than blind religion. By analyzing these metrics, you presumably can gain insights into your strategy’s past performance and make informed decisions about its future.

Since COVID-19 first began its spread in 2020, the united states authorities has poured billions of dollars into growing and purchasing COVID-19 tests as well as vaccines. The Biden administration has given out 1.8 billion COVID-19 checks, including half distributed to households by mail. Using the swab, individuals can detect present virus strains forward of the fall and winter respiratory virus season and the holidays.

Prior to initiating any backtesting or optimizing, traders can put aside a proportion of the historical knowledge to be reserved for out-of-sample testing. One technique is to divide the historic knowledge into thirds and segregate one-third for use within the out-of-sample testing. Only the in-sample knowledge should be used for the initial testing and any optimization.